8 Greatest Catwoman Stories

Selina Kyle, also known as Catwoman, made her debut in Batman #1 way back in 1940. Kyle was simply a cat burglar ...

10 John Constantine, Hellblazer Comic Books You Have to Read Now

John Constantine is one of the most charismatic, cunning, narcissistic, and dangerously unpredictable characters in ...

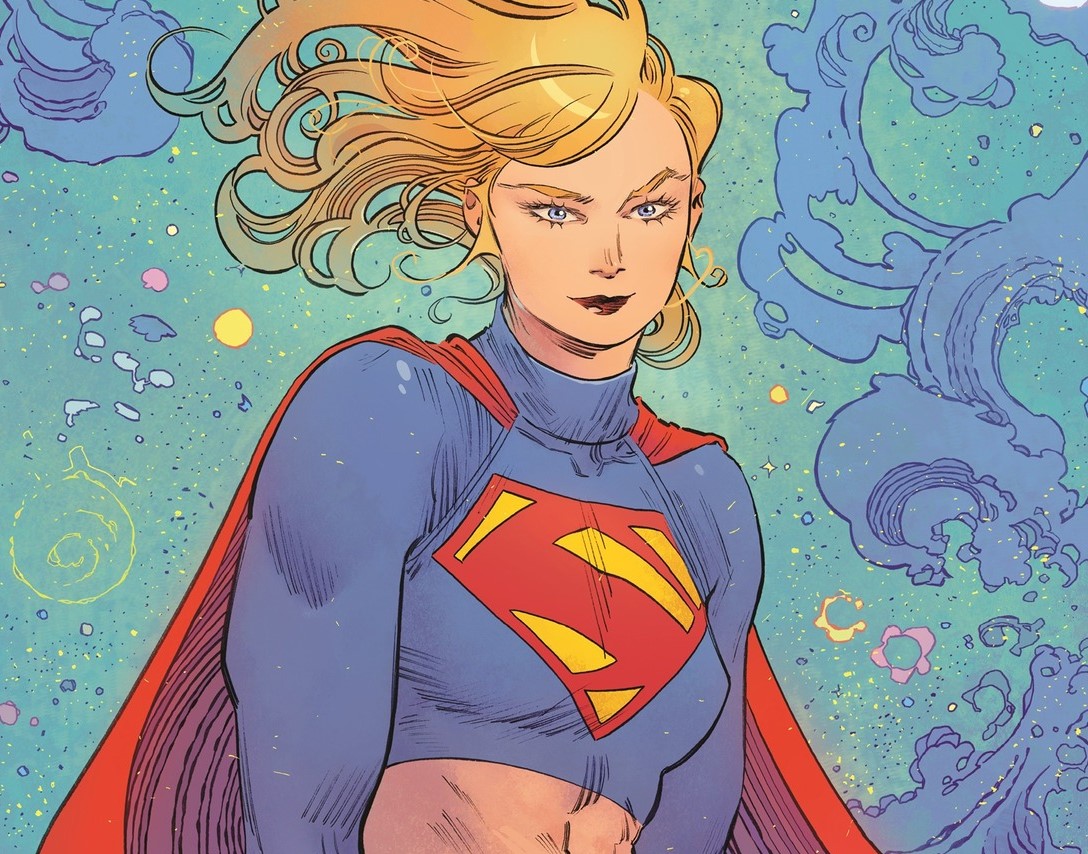

Meet the Powerhouse Women of Comics: Who Are the Female Superheroes?

Female superheroes have risen to prominence, captivating audiences with their strength, resilience, and complexity. ...

8 Pivotal Storylines Where Superheroes Alter Egos Were Exposed

Alter egos are no longer in fashion in comic books. Alter egos were a creative invention in the 20th century and ...

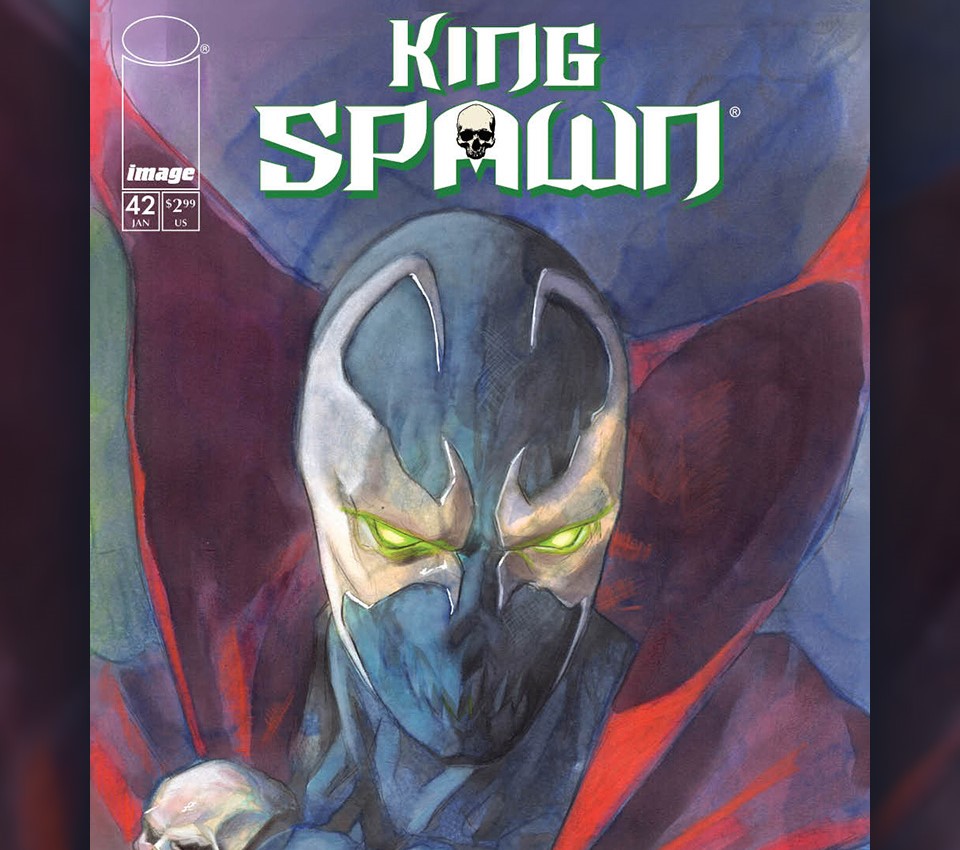

Should There Be A Reboot To Spawn? Here’s What Fans Say

Spawn is a blockbuster comic book series that made its debut in 1992. Superstar comic book creator Todd McFarlane, ...

The 7 Best Comic Book Sleeves For Your Collection

Comic books require constant protection. You can’t just throw raw comic books into a long box, not unless you ...